GGY is a good question. Would need a proper analysis which we haven’t done

Haven’t come to a view on elasticity either, other than to note that HMRC’s 2014 figures would reduce the yield by more than half.

58891 Followers

79 Following

Founder of Tax Policy Associates Ltd. Tax realist. @danneidle on Twitter

Statistics

GGY is a good question. Would need a proper analysis which we haven’t done

Haven’t come to a view on elasticity either, other than to note that HMRC’s 2014 figures would reduce the yield by more than half.

The exchange will have the same tax pressure. Could put up fees but that would make it hard to compare them (good odds, rubbish fees) with offline (rubbish odds, no fees)

Unsure how it would play out. But there’s no free lunch.

That’s not what the IPPR say. They expect more taken from gamblers.

(I don’t know if that’s right, but that’s their approach)

Betting exchanges pay gambling taxes too.

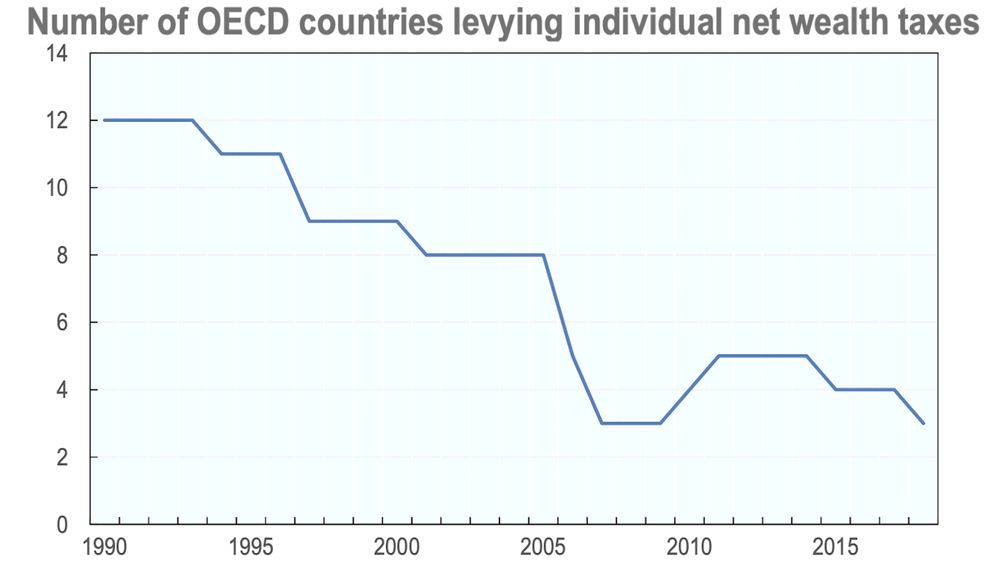

I’m sorry but this is really simplistic. Spain’s wealth tax is a dud, raising only €600m. Why? Because the socialist/communist government knew a serious wealth tax would be hugely damaging.

For more: taxpolicy.org.uk/2025/07/22/u...

Claims of £24bn from a UK wealth tax ignore delays, capital flight (£200–£500bn) risks to growth and employment. Data, country evidence & better reforms.

It’s a depressing conclusion, though, isn’t it?

The same issues arise

I don’t agree. I set out what I thought was needed for a full evaluation, and we don’t have the expertise. taxpolicy.org.uk/2023/06/07/p...

We’ve been asked a few times to analyse the revenue impact of imposing 20% VAT on private schools. We’ve declined, because it’s a complicated piece of work which probably requires a large team with…

But any argument for an increase needs a more robust revenue estimate than the IPPR's use of a static calculation and illustrative tables. And it needs to acknowledge who is actually paying the price.

I expect many people will disagree with me, and be happy to increase the burden on gamblers to fund anti-poverty programmes...