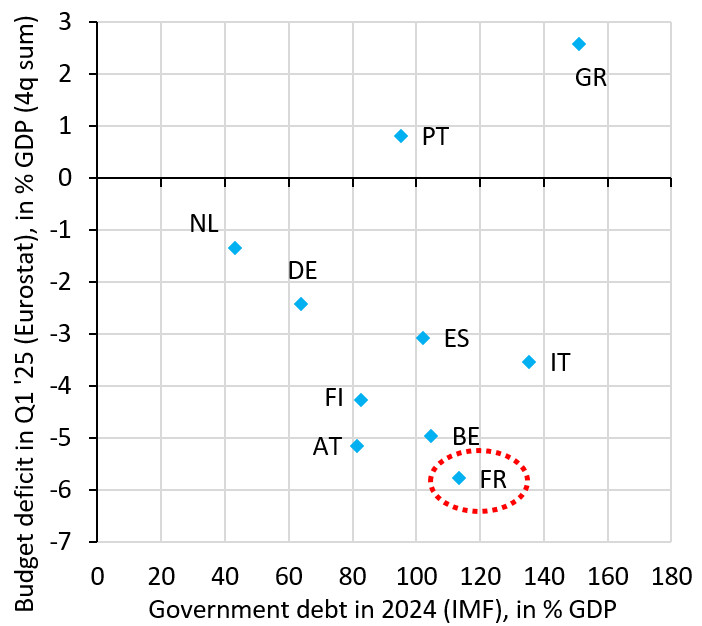

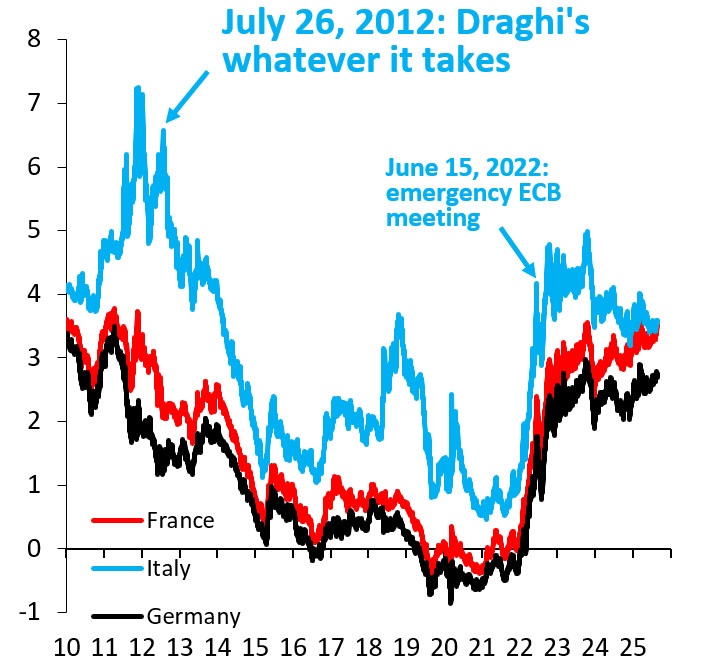

The ECB at various points has intervened in bond markets to cap yields, most recently in 2022. That's produced an equilibrium - no surprise - where high debt countries run wide fiscal deficits because they can. France is a symptom. The ECB is the disease... robinjbrooks.substack.com/p/france-is-...