The extra marginal tax rate will affect millionaires' daily lives almost not at all, which is why in reality none of them would leave the state.

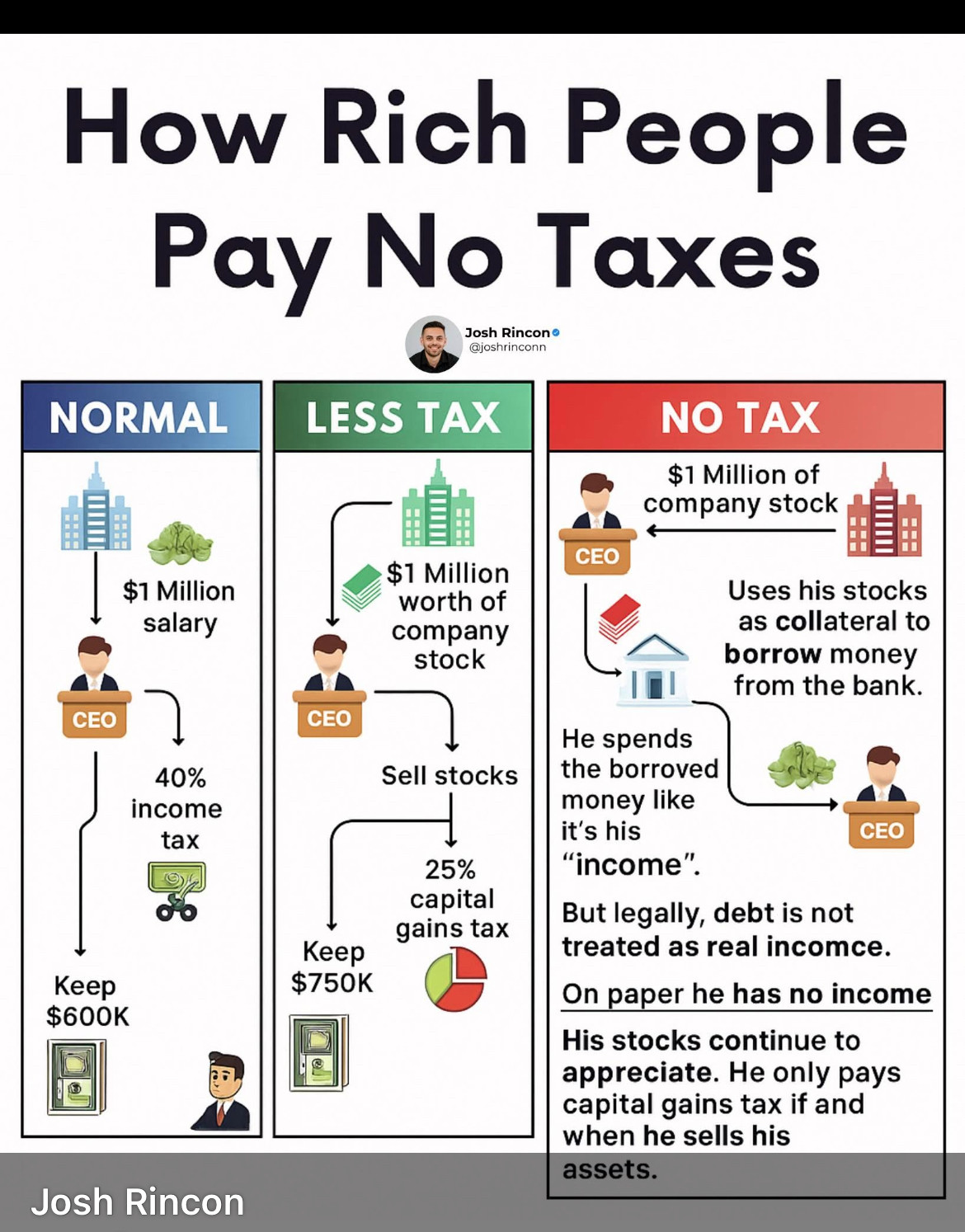

When you have this much money, your accountant/financial folks are already making you as tax efficient as possible.

Not fleeing: New report shows more wealthy residents in Mass., 2 years into 'millionaire's tax'

Despite previous concerns, Massachusetts' "millionaire's tax" hasn't seemed to deter high-earners from continuing to live here, according to a new study from the Institute for Policy Studies.